Rail access to ports is a crucial factor in fulfilling Europe’s freight aspirations according to a new report from McKinsey.

The report, Bold moves to boost European rail freight, highlights that European rail freight has seen a decline in the past 70 years, falling from a 60 per cent modal share in the 1950s to just 15 per cent today.

Additionally, the European Union’s ambitions to double rail freight’s modal share by 2030 to reduce CO2 emissions will require a major shift in trajectory with a need to focus on long-distance freight flows and connections to ports.

Whilst rail transport may be better for the environment, trucking transport remains the favoured option in supply chains as it is better positioned than rail on cost, flexibility, and reach.

The consultancy firm called on European ports to strategise hinterland activity similar to that at the Port of Hamburg, which enabled the port to increase its rail modal share from 30 to 51 per cent in less than three decades.

Through targeted investment in infrastructure at the Port of Hamburg, supply chains triggered a “massive shift,” McKinsey wrote.

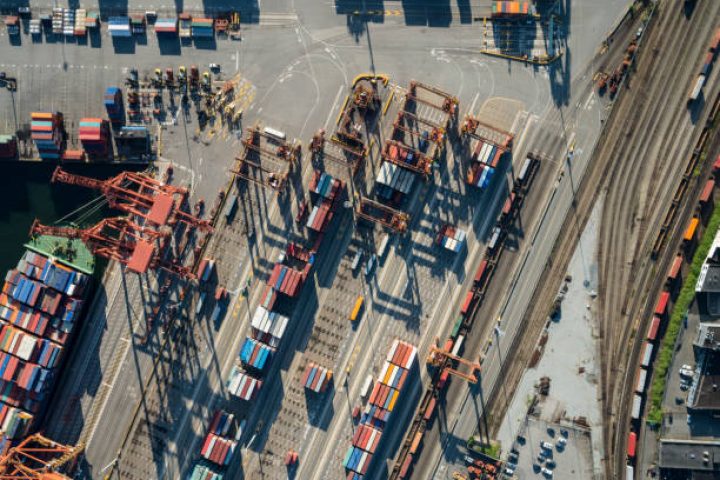

“Ports play a major role in the transport of European goods, handling around 50 per cent of imports and exports,” the consultancy firm said.

“Rail access to ports is therefore a crucial factor in fulfilling Europe’s aspiration for freight rail.”

Other European ports could launch similar initiatives to that of the Port of Hamburg and upgrade infrastructure, as a core priority for increasing rail flows, McKinsey added.

In January alone, the industry saw announcements in rail freight paths in a number of countries across Europe: from the UK, to Germany and Spain.

“Several of the major European import and export port hubs have very low rail modal share, for example, 17 per cent in Felixstowe, 8 per cent in Antwerp, and 7 per cent in Valencia.

“Boosting those modal shares to the region of 40 to 50 per cent would have significant impact on the overall modal share of rail freight in Europe.”